Middle East Tensions Could Nuke Mortgage Rates

Missile exchange between Iran and Israel lands a devasting blow for the U.S. housing market

Tensions in the Middle East, including direct missile exchanges between Israel and Iran, with verified strikes on Iranian oil infrastructure, are raising alarm bells for financial markets over the weekend.

Let's look closer at why this is potentially a devasting blow for the recent improvement in mortgage rates.

🧨 War, Oil, and Mortgage Rates

Historically, war impacts mortgage rates in specific ways — it disrupts trade, triggers volatility in the bond markets, and stokes inflation.

The current conflict will play a key role in commodity prices this week, specifically oil.

Higher oil prices lead to higher inflation, which results in lower demand for bonds, resulting in more expensive mortgage rates as the price of bonds fall.

Let’s look at these dynamics independently.

⚔️ War and Inflation: The Oil Catalyst

War almost always accelerates inflation, and energy prices play a key role.

1. Oil Supply Disruptions = Immediate Inflation Spike

In the case of the Middle East, where a large share of the world’s oil flows through or is produced (e.g., Iran, Iraq, Saudi Arabia), any disruption leads to sharp oil price spikes.

Currently:

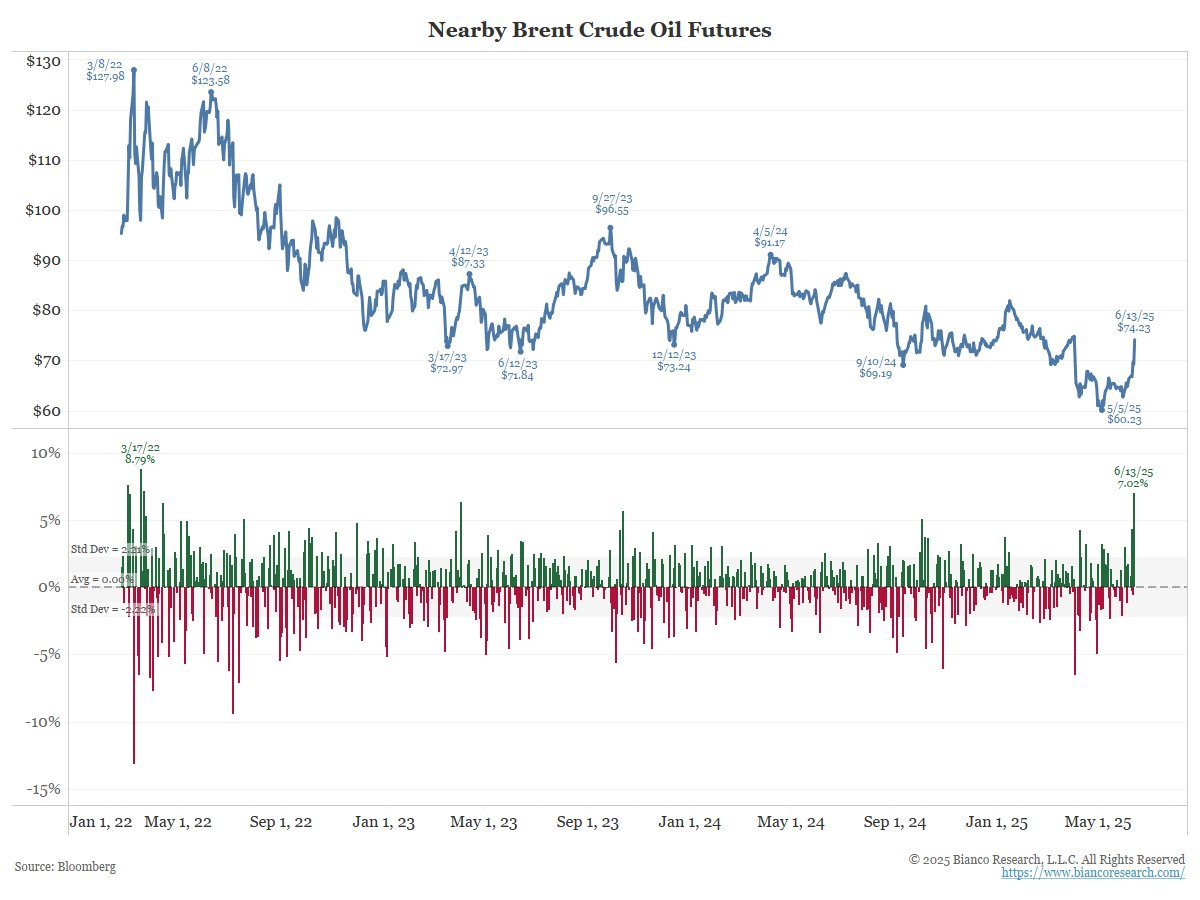

Oil is up 13% week-over-week, and 7% just on Friday.

Iranian refineries have been hit by airstrikes.

Brent crude could surge past $100–$150/barrel if the Strait of Hormuz is affected.

Speculative forecasts peg crude at $85.64 in two weeks.

2. Fuel Costs Feed Broader Inflation

Higher oil prices impact the cost of:

Transportation (airfare, shipping, trucking)

Manufacturing (plastics, chemicals, construction)

Food (fertilizer, farm equipment fuel, logistics)

This leads to headline inflation rising fast, even if core goods/services are stable.

3. Historical Oil Wars & Inflation:

1973 Yom Kippur War & Arab Oil Embargo → U.S. inflation >12%

1990 Gulf War → Oil prices doubled within months

2022 Russia-Ukraine → Brent surged to $139/barrel, U.S. CPI >9%

📉 War and Bond Prices: Inflation’s Backlash

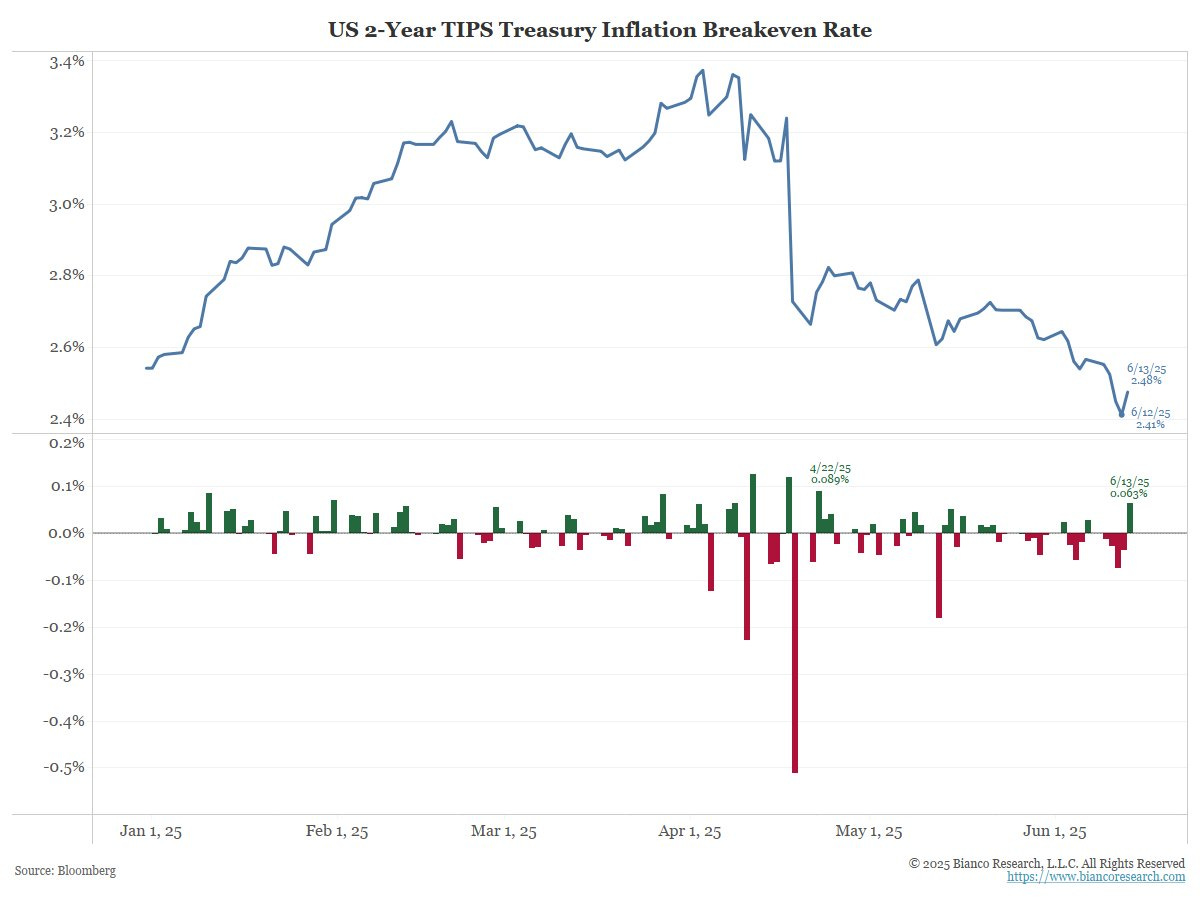

When inflation rises due to war and oil shocks, bond markets suffer:

1. Higher Yields, Lower Prices

Investors sell bonds to avoid inflation erosion, demanding higher yields.

Bond prices fall

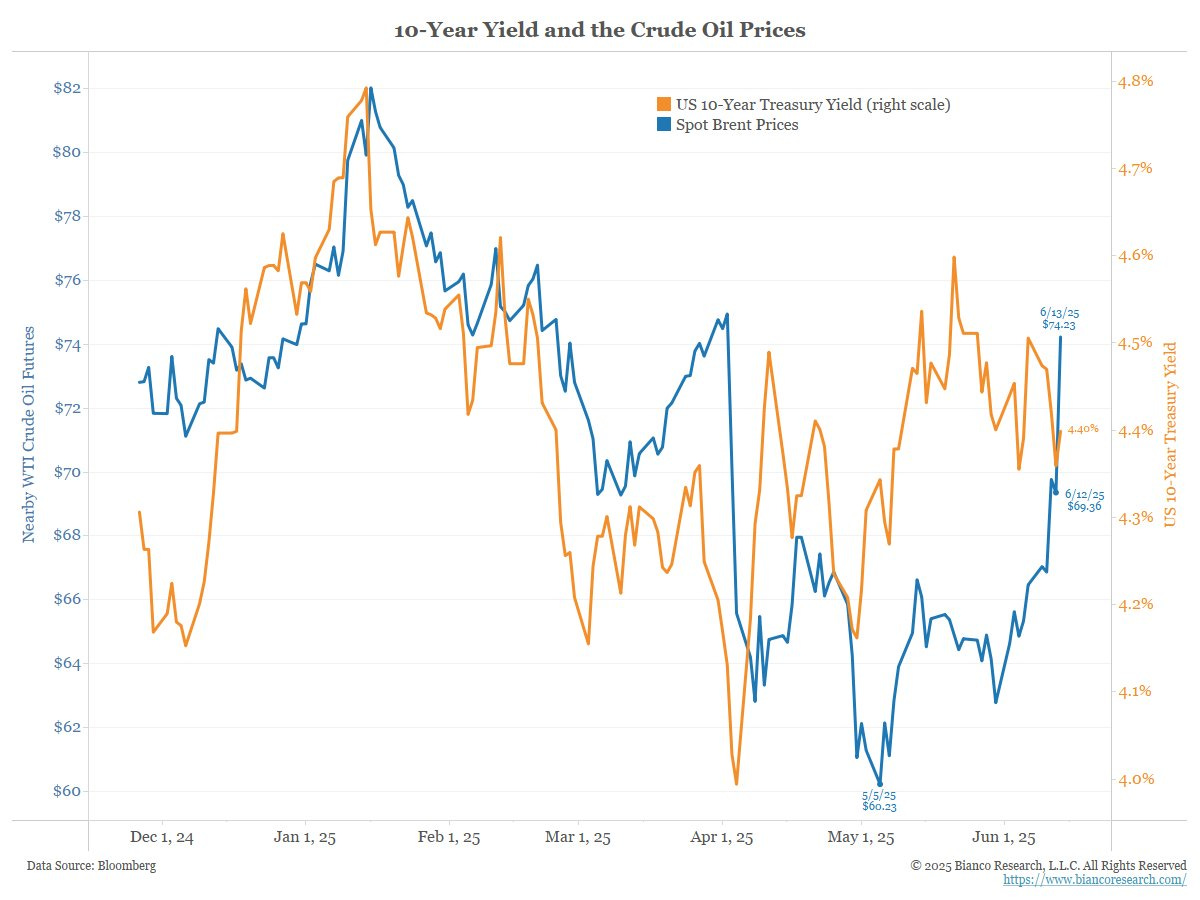

10-Year Treasury yields rise

Price of mortgage rates increase

2. Initial “Flight to Safety” Reverses

While investors initially buy Treasuries in global conflicts, this is often short-lived.

Once inflation expectations rise, bond selloffs begin.

This is what we are starting to witness now:

U.S. 10-year Treasury yields rose on Friday, along with oil prices

Futures priced in less rate cuts, but now rate hikes could be on the table.

3. Historical Analogues:

Vietnam War: Rising deficits + inflation crushed bond prices

Post-9/11: Brief rally in Treasuries followed by inflation fueled sell-off

2022 Ukraine Invasion: After an initial bond rally, oil surged and inflation spiked

🏠 Mortgage Pricing: Why Housing Feels the Pain

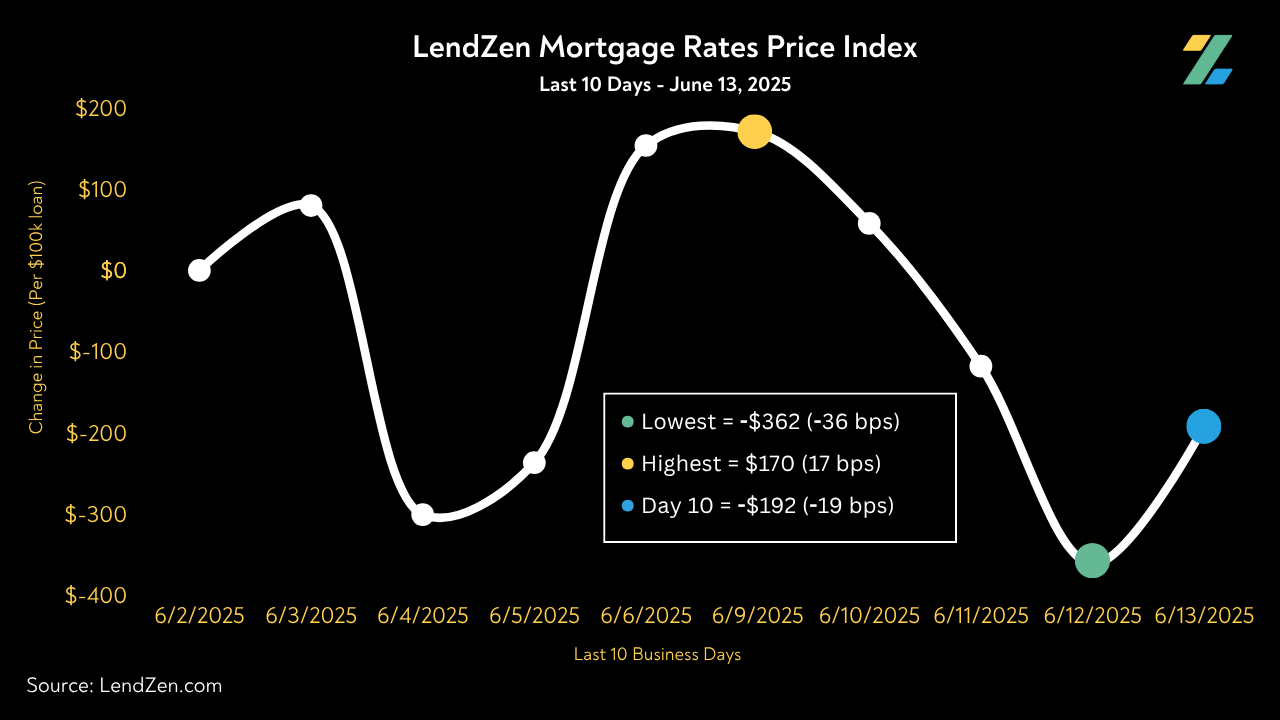

Mortgage rates do not rise or fall, instead, the cost of each rate changes based on the daily fluctuation in the price of mortgage bonds.

When war drives up oil prices → inflation expectations rise → bond prices fall → the price to secure any given mortgage rate becomes more expensive.

The menu of rates remains unchanged, but the cost (or rebate) associated with each rate worsens, meaning:

🧮 You’ll pay more in discount fees (points) to lock in the same rate you could’ve gotten cheaper previously

💸 Borrowers are forced to choose between paying higher upfront costs or accepting higher monthly payments

📉 This erodes affordability and forces many buyers to reduce their purchase budget

The LendZen Index tracks the change in mortgage rate prices across a spectrum of mortgage bonds.

It gives borrowers a clearer picture of how the cost to obtain a mortgage has changed, regardless which rate they are considering.

The index also helps put into context how quickly previous rate quotes can become obsolete, and by how much.

This morning, we could see Friday's jump in price climb much higher.

In addition to tracking mortgage rate price trends with the LendZen Index, you can also anonymously shop all mortgage rates in real-time, as bond prices change, at LendZen.com

🏁In Conclusion

This isn’t just about geopolitics — it’s about the connection between energy, debt, and inflation.

Futures markets are telling us, instead of the usual wartime flight-to-safety in U.S. bonds, this is more likely to be an oil supply shock story that ushers in higher inflation.

Buckle-up and get ready for a wild week!